Article published with permission from Tidwell & DeWitt and Ran One

858.345.4435

Four Pitfalls to avoid, when selling your business

Resources

How many businesses need an exit strategy?

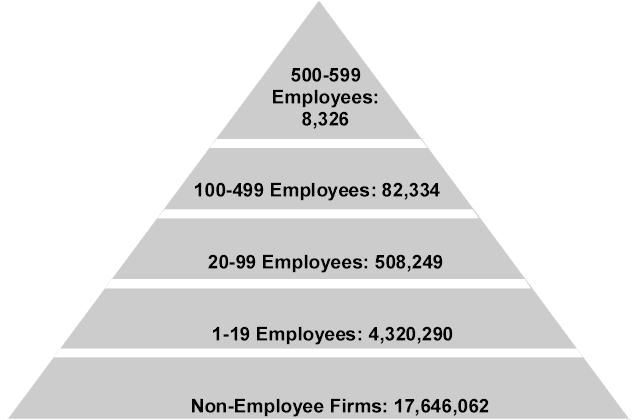

There are nearly 20 million businesses in the United States today. Many exiting owners are surprised to learn that only a fraction of one percent of those businesses have grown to a size where they were able to ‘go public’, i.e. offer their stock to the investing public. This means that the majority of businesses in the United States are privately-held and will need a process other than an Initial Public Offering (IPO) of stock in order to achieve liquidity or turn the company stock (or assets) into cash.

A Wide Base of the Triangle

The majority of businesses in the United States today are ‘small’ businesses – enterprise values of less than a few million dollars. The chart below illustrates the wide base of small

businesses relative to the very small number of large, publicly traded businesses (organized by the number of employees within each organization).

2004 U.S. Census Bureau Statistics

Implications for the Exiting Business Owner

The statistics offered here contain both good news and bad news. The good news is that you are not alone in needing a plan for the exit from your business. The bad news is that you are not alone in needing a plan for the exit from your business. What this means is that as the Baby Boomers begin to exit these businesses through retirement, the supply will likely outweigh the demand for business ownership. We address this in more detail towards the end of this Newsletter.

Exit Strategy Planning Advisors

Ask yourself how many ‘exit strategy planning’ advisors you know of. The answer is probably ‘none’. The significance of this dichotomy of demand for this service versus the supply of trained advisors should encourage you to ask, ‘Who is going to be available to assist me with the exit from my business?’ In other words, how will you go about establishing a plan for the exit from your business?

Size Matters

To put the exit strategy planning challenges into even greater perspective, it needs to be stated that smaller business owners are generally going to have a harder time with their exit strategy planning than larger businesses. Small business enterprises are more dependent upon the proceeds from the exit to satisfy their post-exit financial expenses because these owners tend to ‘live out of their businesses’. Once the habit of ‘running expenses through the business’ is no longer available, that owner’s post-exit lifestyle can be compromised. Another way of putting this is that the owner’s financial gap is large and needs to be satisfied with the ‘highest price’ on the exit.

So, Who Can Buy the Business?

Again, the demographics work against the Baby Boomer who is looking to retire. There are approximately 78 million Baby Boomers looking to retire. With all of these retiring workers, who is going to fill the gap – or, more appropriately, who is going to succeed you in your business, allowing you to maximize your exit value?

The Economy Matters

As we turn the corner into 2008, we are facing many uncertain times. The U.S. economy seems to be slowing and the credit markets are clearly tightening. These factors have some relevance to your business exit as a slowing economy creates a reduced demand for the purchase of businesses. This could present yet another challenge to your exit strategy planning.

Given that recessions tend to last for a few years (on average), you need to consider this fact in gauging your timing for your exit strategy plan.

With the first Baby Boomers turning 62 years old in 2008, an economic slow-down may result in many of these exiting owners holding onto their enterprises for another few years. When the economy does eventually recover, these Boomers will be 64 or 65 years old. At that point in time, we can forecast that many will be anxious to exit their businesses as retirement draws closer and closer.

These forecasts, if correct, will result in a glut of businesses in need of buyers or successors. Without many buyers or successors available, and with a small supply of advisors who can assist with this type of transaction, the prospects begin to work against the exiting Baby Boomer business owner.

Protect Your Wealth, Start Planning Today

You should begin to consider your exit strategy planning today in order to protect the wealth that is trapped in your illiquid business. Plan your exit and work that plan. This way, you will be prepared no matter what the financial and economic markets bring. A well thought out exit strategy plan is your best approach towards reaching your exit goals.

858.345.4435

Supply and Demand for Businesses

Resources

Copyright Henberger Group Inc.

Recommend this article to a friend