Article published with permission from Tidwell & DeWitt and Ran One

858.345.4435

Four Pitfalls to avoid, when selling your business

Resources

All business owners want to know the ‘value’ of their business. You - as an exiting owner - need to understand that the value of your company is a ‘range concept’ - there is no single value for the shares of your privately held business.

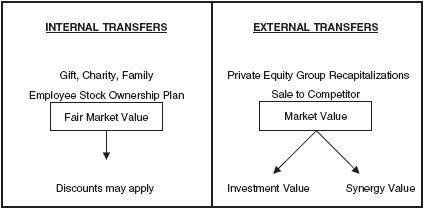

The easiest way to understand this range of values concept is to begin with the differences between an internal transfer and an external transfer of your business - see the chart below.

You will observe that internal transfers, such as Employee Stock Ownership Plans (ESOPs), Gifting programs, and Charitable Transfers are governed by a valuation standard called Fair Market Value. A Fair Market Valuation appraisal is completed by professional evaluators who render a single ‘point in time’ value for your company.

You will also see that external transfers are measured by what different types of market players are willing to pay you for your business. For example a financial buyer, such as a private equity group, may be willing to pay you the ‘investment value’ for your business – this is the value to them as an investor in your enterprise. This valuation assumes that the financial buyer is not already in your business or a similar line of business.

A market-buyer who is in your business, or a similar line of business, may be able to pay you a ‘synergy value.’ What this simply means is that this type of buyer may be able to reduce certain costs, or take advantage of certain efficiencies achieved by acquiring your business. For example, selling your business to a competitor may allow that buyer to reduce overhead associated with financial and sales operations because they already have their own systems and people in place to handle those aspects of the business. These types of cost cuts or efficiencies are called ‘synergies’, hence the term ‘synergy value’.

Synergy value is theoretically the highest value that you can receive for your business. However, only 5% of businesses will successfully sell to an outside buyer. So we see that an understanding of the ‘range of values’ concept becomes relevant to the majority of exiting business owners.

There are advantages and disadvantages to both internal and external exit strategies plans. In short, a sale to a synergistic buyer causes you to lose control of the business as well as forfeit any future value in the business.

A sale to a financial buyer, such as a private equity group, will generally cause you to sell strategic and financial control, but may leave you the opportunity to continue running the day-to-day operations (operational control), whereby your salary and benefits continue. And, you may also be able to maintain a minority stake in the ownership of the business, thereby participating in the future value of the company that you continue to build. Participating in future value and receiving continued income should be included in the ‘value’ of the exit strategy plan that you design.

A sale to an ESOP or a gift to a charity or to family is measured under the Fair Market Value standard. All things being equal, this Fair Market Value standard is lower than the market values of investment and synergy value.

Fair Market Value is a standard of measuring a company’s value that is used by the tax courts and the Internal Revenue Service (IRS) when evaluating a ‘stated’ value for a business. In terms of standards and processes, fair market value is the most structured type of valuation. The process for determining the fair market value of a company is derived from IRS Revenue Ruling 59-60 which defines fair market value as “the price at which property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of the relevant facts . . . the hypothetical buyer and seller are assumed to be able and as well as willing, to trade and to be well informed about the property and concerning the market for such property.”

From this definition came a series of steps that are used by professional evaluators to determine the fair market value of your business.

So again, the fair market value does not necessarily reflect the premiums that can be achieved when an exiting owner decides to sell to an outside buyer such as a competitor or a private equity group. But even though the overall value may be lower, the exiting owner may experience much more flexibility and continued control with an internal transfer using the fair market value standard.

In short, internal transfers do not include an ‘outside’ party. Therefore, the exiting owner has the ability to construct a plan for their exit that is customized. Whether that exiting owner is negotiating with their management team, or selling shares to an ESOP, or transferring a portion of their wealth to family members or to charities, their ability to control the transaction is increased. The trade-off for this increased control is [generally speaking] a lower value for the business.

In conclusion, when formulating your exit strategy plan a few very important points can be highlighted for your consideration:

- Most businesses will not successfully sell to an outside party, so it makes sense to begin to understand ‘internal’ transfer strategies and their values.

- The internal valuation of Fair Market Value will generally produce a lower overall value for the business, but the ability to control the transaction, as well as potential savings on taxes and professional fees may more than make up for this diminished value.

- Professional appraisers are used to determine Fair Market Value whereas Market Value is determined through a sales process whereby your company is offered to the buying or investing marketplace and whatever that marketplace is willing to pay you for your business is the Market Value that you receive (from this amount you need to also determine your taxes and professional fees that are owed).

An exiting owner is well served in understanding that the ‘value’ that they receive for their business may not be the most important factor to consider in their exit strategy planning. Beyond the entrepreneur who knows that they want to sell to a competitor for the highest price, there are millions of other business owners who have strong incentives to pass their businesses to managers, co-owners, family, and charities of their choosing. Although these transfers may not yield the highest sales price, they may ultimately produce an outcome that is much more favorable to that exiting owner’s personal goals.

858.345.4435

The Many Values Of Your Business

Resources

Copyright Henberger Group Inc.

Recommend this article to a friend